OROGEN ROYALTIES INC (:OGN) Orogen Royalties Announces Profitable Quarter and Strong Cashflow for Q2-2023

Transparency directive : regulatory news

VANCOUVER, BC / ACCESSWIRE / August 28, 2023 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to report profitable financial results from its operations for the second quarter ended June 30, 2023.

Paddy Nicol, CEO of Orogen, commented: "We are happy to report another profitable quarter, supported by strong royalty revenue, a sustainable prospect generation business, and reduction in overhead and G&A expenses. This resulted in a 178% increase in cashflow from operations from the previous quarter which further strengthens the company's balance sheet. We look forward to continuing strong revenue performance in H2 with First Majestic increasing production at Ermitaño by 27%. During the quarter, we have continued to grow our mineral properties and royalty assets through prospect generation activities and acquisitions. An estimated 28,000 metres (approximately $18 million) of partner funded drilling and exploration activities are planned on Orogen's properties in 2023. Low-risk exposure to discovery is at the core of Orogen's business model and exemplified by AngloGold's recent disclosure of an exploration target of 6 to 8 million ounces of gold for the Merlin zone1 at the Silicon-Merlin project, where the company holds a 1.0% NSR royalty."

Q2 2023 Highlights

All amounts are in Canadian dollars unless otherwise stated.

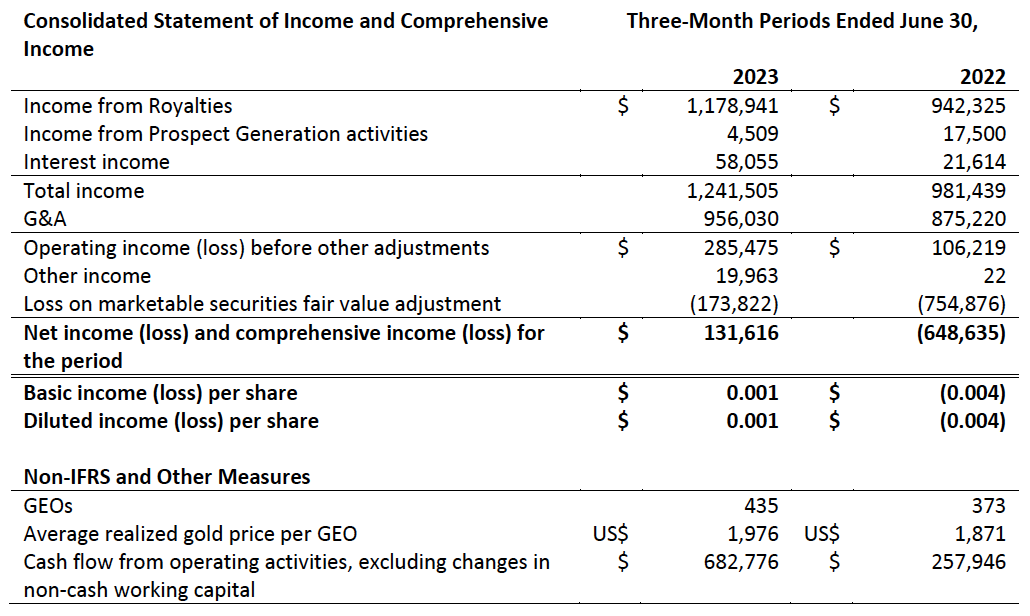

- Net Income from Operations: Net income was $131,616 for the three-month period ended June 30, 2023, compared to a net loss of $648,635 for the same period in 2022. This resulted in a net income of $763,829 or $0.004 per share year to date (2022 - net loss $222,554 or $0.001 per share).

- Royalty Revenue: Royalty revenue of $1,178,941 was earned during the current period with 435 attributable gold equivalent ounces ("GEOs") sold at average price of US$1,976 per ounce, up 25% compared to the same period in 2022 and down 10% compared to the previous quarter.

- G&A Expenses: General and administrative expenses of $956,030 were incurred in the current period, up 9% compared to the same period in 2022 and down 36% compared to the previous quarter.

- Cash flow: Cash flow of $455,289 was generated from operating activities in the current period. Cash flow generated from operating activities, excluding changes in non-cash working capital, was $682,776, up 165% compared to the same period in 2022 and up 178% from the previous quarter.

- Working Capital: The Company has working capital of $16,796,224 at June 30, 2023 compared to $12,083,375 at the beginning of the fiscal year, an increase of $4,712,849. The Company has no long-term debt.

For complete details of the Company's financial results, please refer to the condensed interim consolidated financial statements and MD&A for the six-month periods ended June 30, 2023, and 2022. The Company's filings are available on SEDAR at www.sedar.com and on Orogen's website at www.orogenroyalties.com. Please also see non-IFRS Measures at the end of this news release.

Summary of Results

First Majestic Silver Corp. ("First Majestic") operates the Ermitaño mine, where the Company holds a 2.0% net smelter return ("NSR") royalty. For the current quarter, the Company recorded $1,178,941 in royalty revenue consisting of 435 GEOs. Production at Ermitaño include 213,878 tonnes processed containing average gold and silver head grades of 3.12 grams per tonne ("g/t") and 39 g/t, respectively, producing 20,073 ounces gold and 142,037 ounces silver. Total GEOs produced attributable to the Company's NSR royalty decreased by 14% in the second quarter, due to lower gold grades compared to the previous quarter. However, both gold and silver recoveries achieved record highs in the second quarter averaging 94% and 52%, respectively, compared to 90% and 50% from the first quarter. These improvements in recovery were driven by investments made by First Majestic to improve plant performance when processing ore from Ermitaño. First Majestic forecasts production from Ermitaño to increase by 27% to between 48,000 to 53,000 ounces gold and 700,000 to 800,000 ounces silver for H2-2023.

During the current period, the Company incurred $956,030 (2022 - $875,220) in G&A expenses. This is an increase of 9% compared to the same period in 2022 and a reduction of 36% compared to the prior quarter. The reduction in G&A expenses was due to continued optimization of administrative functions and lower overhead costs, which were offset by higher stock-based compensation cost for long-term equity-based compensation vested during the period.

The Company capitalized $2,810,093 in acquisition and exploration expenditures from royalties and mineral property interests and recognized $238,261 in recoveries during the current period. During the quarter, the Company completed its first material royalty asset acquisition on the La Rica project located in Colombia. The Company acquired a 1.0% NSR royalty on the project by paying a cash consideration of US$1.75 million. The area of interest contains at least four undrilled copper-gold porphyry targets within a fifteen kilometre long trend of anomalous copper geochemistry on the western margin of the Mande Batholith. To date, the Company has 24 royalties in Canada, United States, Mexico, Argentina, Kenya, and Colombia, most of which were generated organically through the Company's prospect generation business. The Company also has 11 mineral properties under option, 8 projects that are available for sale or option and one alliance.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., VP Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released third-party information and the Company is relying on the interpretation provided. Additional information can be found on the links in the footnotes.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Silicon-Merlin gold project (1.0% NSR royalty) in Nevada, U.S.A, being advanced by AngloGold Ashanti. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Forward-looking information in this news release includes disclosures regarding NSR royalty payments to be paid to the Company by First Majestic Silver Corp. ("First Majestic"), the owners and operator of the Ermitaño mine located in Mexico and that the forecasted revenue which are based on First Majestic "NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates" having an effective date of June 30, 2021. In addition to the technical report, the disclosure herein also contains and the updated mineral reserve and resource estimates for the Ermitaño mine based on the Santa Elena Mineral Reserve, Resource Estimates with an effective date of December 31, 2022 as announced by First Majestic on March 31, 2023 and as disclosed in their December 31, 2022 AIF, and First Majestic's MD&A for the period ended March 31, 2023. Forward-looking statements are based on several material assumptions, which management of the Company believe to be reasonable, including, but not limited to, the continuation of mining operations in respect of which the Company will receive NSR royalty payments, that the commodity prices will not experience a material adverse change, mining operations that underlie the royalty will operate in accordance with the disclosed parameters and other assumptions may be set out herein.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a Royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a Royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds Royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds Royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's Royalty or other interest. Orogen's Royalty or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

Non-IFRS Measures

The Company has included certain results in this news release that do not have any standardized meaning prescribed by International Financial Reporting Standards ("IFRS") including total GEOs sold, average realized gold price per GEO, and cash flow from operating activities excluding changes in non-cash working capital adjustments. The Company's royalty revenue is converted to a gold equivalent ounce by dividing the royalty revenue received during the period by the average gold price of the period. The Company has also used the non-IFRS measure of operating cash flows excluding changes in non-cash working capital. This measure is calculated by adding back the decrease or subtracting the increase in changes in non-cash working capital to or from cash provided by (used in) operating activities.

1. Cautionary Note: The ranges of tonnage and grade of the Exploration Target are conceptual in nature and could change as the proposed exploration activities are completed. There has been insufficient exploration of the relevant property or properties to estimate a Mineral Resource at this point in time. It is uncertain if further exploration will result in the estimation of a Mineral Resource and the Exploration Target therefore does not represent, and should not be construed to be, an estimate of a Mineral Resource or Mineral Reserve. Given the conceptual stage of the project, a number of risks, uncertainties and opportunities, are evident in the confidence of the known orebody and the potential for upside at Silicon, Merlin and in the surrounding area. The Merlin Exploration Target grade and tonnage ranges have been determined by a preliminary review of the location and weighted average grade of the mineralised intercepts. The geology of the deposit contains a significant number of faulted offsets, which require detailed geological modelling to fully define the extent and continuity of the mineralisation. A bulk density value of 2.4 t/m3 was used. No economic constraint has been applied to the deposit to determine the extent of what material may ultimately be extracted.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/777340/Orogen-Royalties-Announces-Profitable-Quarter-and-Strong-Cashflow-for-Q2-2023